Key Countries Replacing China in Low-Cost Manufacturing Post-Trade War

Which Countries Are Replacing China’s OEM Manufacturing?

Since the US-China trade war, several countries have emerged as alternatives to China’s low-cost manufacturing industry. Companies that once heavily relied on China have moved their production to these regions to avoid tariffs, reduce dependence on China, and diversify their supply chains.

Which countries are seeing the most manufacturing shifts?

The key areas of shift are divided into two main regions: North America, particularly Mexico and Canada, and Southeast and South Asia.

Vietnam, India, and Mexico have become major hubs, especially in electronics, textiles, and metal hardware production. Bangladesh, Cambodia, and Myanmar continue to focus on low-cost textile and garment manufacturing. Indonesia and Malaysia have also seen growth in electronics and hardware accessories production.

It’s clear that countries near China, such as those in Southeast and South Asia, are the main recipients of these shifts, largely due to their significantly lower labor costs compared to China, which has driven the migration of manufacturing.

Below are the key countries that have replaced China in low-cost manufacturing, benefiting from their low labor costs, favorable trade agreements, and geographical advantages to absorb production shifted from China due to tariffs, wage increases, and the need for supply chain diversification.

1. Vietnam

Why choose Vietnam?

Vietnam has become one of the biggest beneficiaries of the US-China trade war. Its proximity to China, competitive labor costs, and government policies supporting foreign investment have made it a highly attractive destination for manufacturers.

Key industries, such as textiles, apparel, furniture, and hardware production, have moved to Vietnam. Major companies like Samsung, Apple, and Nike have either expanded production or shifted parts of their supply chains to Vietnam. The country’s advantages include low wages, a young workforce, and participation in regional trade agreements like RCEP, making its manufacturing exports even more appealing.

- GDP (2023): $408 billion

- Manufacturing contribution to GDP: ~16%

- Average monthly salary (2023): $290 – $350

- Exports (2023): Electronics ($108 billion); Textiles and Apparel ($38 billion)

- Key Companies: Samsung, Nike, Apple suppliers

2. India

Why choose India?

India has long positioned itself as a replacement for Chinese manufacturing, particularly through its “Make in India” initiative. The country’s large population, relatively low labor costs, and government incentives for manufacturers have attracted substantial investment.

Industries like electronics assembly, pharmaceuticals, automotive, and furniture hardware manufacturing have seen significant growth in India. Companies like Apple have increased iPhone production in India to reduce dependence on China. India boasts a large pool of skilled labor and is an important market for multinational companies, making it an attractive location for global supply chain diversification.

- GDP (2023): $3.73 trillion

- Manufacturing contribution to GDP: ~15.5%

- Average monthly salary (2023): $200 – $450

- Exports (2023): Textiles and Apparel ($35 billion); Automobiles ($13 billion); Electronics and Electrical Equipment ($17 billion)

- Key Companies: Foxconn, Tata Motors, Samsung, Apple

3. Mexico

Why choose Mexico?

Due to its proximity to the US and participation in the USMCA (United States-Mexico-Canada Agreement), Mexico has become the preferred nearshore production destination for companies close to the US market.

Mexico has become a hub for automobile manufacturing, electronics, and consumer goods. US companies find Mexico attractive due to lower transportation costs, shorter delivery times, and favorable trade conditions. In addition to being close to the US, Mexico offers competitive labor costs, especially compared to the US. USMCA ensures that products made in Mexico can trade with the US tariff-free.

- GDP (2023): $1.48 trillion

- Manufacturing contribution to GDP: ~17%

- Average monthly salary (2023): $350 – $500

- Exports (2023): Automobiles ($96 billion); Electronics ($70 billion)

- Key Companies: General Motors, Ford, Flextronics

4. Bangladesh

Why choose Bangladesh?

Bangladesh has long been a major player in the garment and textile industry due to its extremely low labor costs. The trade war has accelerated this trend, as businesses seek cheaper alternatives to China.

Bangladesh specializes in textiles, apparel, and footwear, with major global brands such as H&M, Zara, and Walmart sourcing from the country. Its low wages make Bangladesh one of the most competitive destinations for labor-intensive manufacturing, especially in the garment sector. The government also offers tax incentives and export processing zones (EPZ) to attract foreign investment.

- GDP (2023): $460 billion

- Manufacturing contribution to GDP: ~20%

- Average monthly salary (2023): $100 – $120 (garment industry)

- Exports (2023): Textiles and Apparel ($44 billion)

- Key Companies: H&M, Zara, Walmart suppliers

5. Thailand

Why choose Thailand?

Thailand has a well-established industrial base, particularly in the automotive and electronics sectors. The country benefits as companies look to move their supply chains away from China.

Thailand is a hub for automotive, electronics, and electrical goods manufacturing. Major automotive manufacturers like Toyota and Ford have extensive production facilities in the country, and Thailand is a leading producer of hard drives and other tech components. The country offers competitive labor costs and skilled workers and is a member of regional trade agreements like RCEP, which makes exporting to the Asia-Pacific region easier.

- GDP (2023): $565 billion

- Manufacturing contribution to GDP: ~27%

- Average monthly salary (2023): $300 – $450

- Exports (2023): Automobiles ($35 billion); Electronics ($37 billion)

- Key Companies: Toyota, Ford, Western Digital

6. Indonesia

Why choose Indonesia?

With its large population, low wages, and government policies aimed at attracting foreign investment, Indonesia has become an attractive destination for manufacturers seeking alternatives to China.

Indonesia has become a key player in industries such as textiles, furniture hardware accessories, electronics, and automotive manufacturing. Companies like Nike and Adidas have large manufacturing operations in Indonesia. The country’s low labor costs, strategic location as a Southeast Asian maritime hub, and improved infrastructure make it a compelling choice for companies seeking to diversify their manufacturing.

- GDP (2023): $1.39 trillion

- Manufacturing contribution to GDP: ~21%

- Average monthly salary (2023): $150 – $250

- Exports (2023): Textiles and Footwear ($13 billion); Electronics ($9 billion)

- Key Companies: Nike, Adidas, Panasonic

7. Malaysia

Why choose Malaysia?

Malaysia has become a strong contender for companies looking to relocate production, particularly in electronics and semiconductors. The country has a relatively skilled workforce and is well-connected to global supply chains.

Malaysia is a leading producer of semiconductors, electronics, electrical hardware accessories, and medical equipment. It has attracted investment from global tech giants looking to diversify production away from China. Malaysia’s industrial infrastructure is more developed than some of its Southeast Asian neighbors, and its labor costs remain competitive for certain industries.

- GDP (2023): $432 billion

- Manufacturing contribution to GDP: ~22%

- Average monthly salary (2023): $500 – $600

- Exports (2023): Electronics and Semiconductors ($100 billion); Medical Devices ($8 billion)

- Key Companies: Intel, Western Digital, Bosch

8. Cambodia

Why choose Cambodia?

Like Bangladesh, Cambodia has become a key player in the garment and textile industries due to its low labor costs, making it attractive for labor-intensive manufacturing, particularly for export.

Cambodia specializes in textiles, apparel, and metal stamping. Major brands outsource their production to Cambodia. The Cambodian government offers incentives for foreign investment, such as tax holidays and free trade zones, while low wages and growing manufacturing infrastructure further enhance its appeal.

- GDP (2023): $32 billion

- Manufacturing contribution to GDP: ~34%

- Average monthly salary (2023): $180 – $200

- Exports (2023): Textiles and Apparel ($10 billion); Footwear ($1 billion)

- Key Companies: H&M, Adidas, Zara suppliers

9. Philippines

Why choose the Philippines?

The Philippines boasts a young, English-speaking workforce and is strategically located near major shipping routes, making it an attractive destination for electronics and manufacturing companies.

The Philippines excels in semiconductor production, electronics assembly, and business process outsourcing (BPO). Industries such as automotive parts and consumer electronics have grown rapidly in recent years. The country benefits from a low-cost labor market and government incentives aimed at attracting foreign manufacturing investment.

- GDP (2023): $434 billion

- Manufacturing contribution to GDP: ~20%

- Average monthly salary (2023): $280 – $400

- Exports (2023): Electronics and Semiconductors ($45 billion); Automotive Parts ($4 billion)

- Key Companies: Texas Instruments, Samsung, Mitsubishi

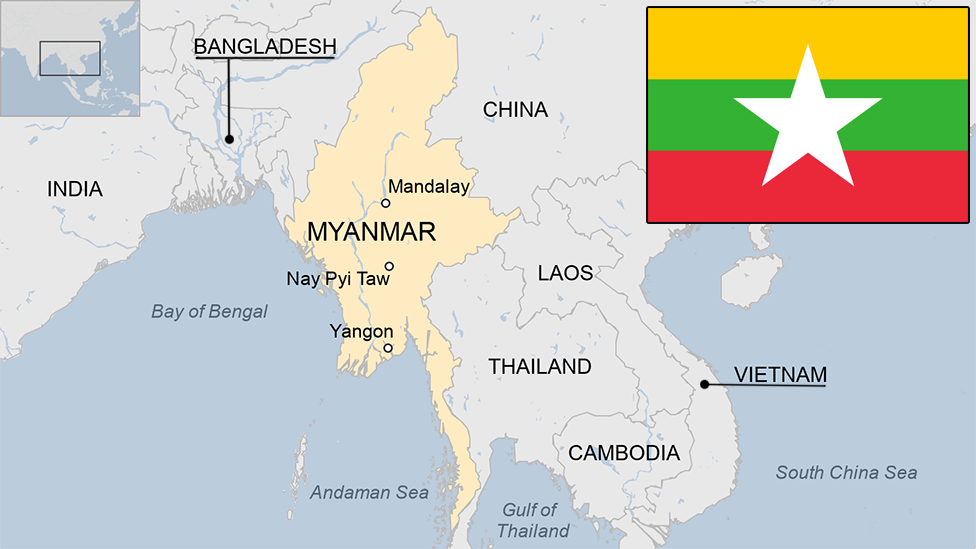

10. Myanmar

Why choose Myanmar?

Although Myanmar’s industrial base is still developing, it has become an affordable alternative for labor-intensive industries like textiles and apparel.

Myanmar’s garment and textile production has been growing steadily, with some companies shifting production from China to take advantage of lower wages. Myanmar’s low wages and recent reforms aimed at attracting foreign investment have made it a competitive destination for low-cost manufacturing.

- GDP (2023): $63 billion

- Manufacturing contribution to GDP: ~24%

- Average monthly salary (2023): $100 – $120 (garment industry)

- Exports (2023): Textiles and Apparel ($6 billion); Footwear ($500 million)

- Key Companies: H&M, Zara suppliers